Business

Trump raises tariffs to 15% on imports from all countries

Posted on Saturday February 21, 2026

President announced increase from 10% using different authority from mechanism that supreme court struck down on FridayDonald Trump announced on Saturday that he would raise a temporary tariff rate on US imports from all countries from 10% to 15%, less than 24 hours after the US supreme court ruled against the legality of his flagship trade policy.Infuriated by the high court’s ruling on Friday that he had exceeded his authority and should have got congressional approval for the tariffs he introduced last year under the International Emergency Economic Powers Act (IEEPA), the US president railed against the justices who struck down his use of tariffs – calling them a “disgrace to the nation” – and ordered an immediate 10% tariff on all imports, in addition to any existing levies, under a separate law. Continue reading...

High energy prices threaten UK’s status as manufacturing power, business groups say

Posted on Sunday February 22, 2026

CBI and Energy UK report finds 40% of firms have cut investment as electricity costs remain far above pre-Ukraine levelsThe UK is at risk of losing its status as a major manufacturing centre after a sharp rise in energy prices that has forced about 40% of businesses to cut back investment, according to a report by the CBI and Energy UK.In a stinging message to ministers, the report said British businesses – from chemical producers to pubs and restaurants – were being undermined by a failure to cap prices and upgrade the UK’s ageing gas and electricity networks. Continue reading...

‘Eye-watering numbers’: food producers sound alarm on rise in energy charges

Posted on Sunday February 22, 2026

Indoor growers warn April price jump will hinder sector’s competitiveness and drive up costs for consumersOutside, it’s an overcast and blustery February day in Kent – hardly the ideal conditions for growing tomatoes, cucumbers and peppers. Yet inside the enormous glasshouses run by grower Thanet Earth, the climate has been optimised to a humid 20C, perfect for the regimented rows of small pepper plants poking out of raised trays.Growing fresh produce indoors in the south of England year-round requires plenty of energy to provide light, warmth and carbon dioxide. But the site’s energy bills are about to grow too, when a significant increase in electricity standing charges comes into force on 1 April. Continue reading...

Romance fraud: warning over scam that turns victims into insurance cheats

Posted on Sunday February 22, 2026

Insurers say cases of scammers manipulating people into staging crashes and filing bogus claims are under-reportedRomance fraud typically evokes images of people being tricked out of their life savings by partners they meet on dating sites, but some scammers use a different tactic: recruiting unsuspecting victims into fake insurance claims.The scam involves a fraudster convincing their partner, or a person they are dating, either to say they have witnessed a car accident, or to take out an insurance policy and file a bogus claim in order to secure a payout. Continue reading...

Decline in remote jobs risks shutting disabled people out of work, study finds

Posted on Saturday February 21, 2026

Research project warns fall in homeworking roles could undermine efforts to reduce unemploymentA decline in the number of jobs for people who need to work remotely, including those with disabilities, could undermine the government’s efforts to reverse rising unemployment, according to a two-year study.More than eight in 10 respondents to a survey of working-age disabled people by researchers at Lancaster University said access to home working was essential or very important when looking for a new job. Continue reading...

Cemented locks and deflated diggers: the war over privately run allotments

Posted on Saturday February 21, 2026

With waits for council plots in England decades-long, Roots is renting out green space – but some communities are digging inWhen police arrived at the field outside Bristol in October 2023, two old cars, wheels removed, were blockading the gates. Protesters had hauled them across the entrance to stop developers building on the slice of north Somerset green belt. The threat was not housing or industry, but a company building vegetable patches.Roots builds privatised allotments to give city dwelling customers a place to grow food. It was co-founded in 2021 by Christian Samuel, Ed Morrison and William Gay, who were frustrated by a 28-year waiting list for a plot in their area of Streatham, south London. “We thought: ‘This is crazy’,” says Samuel, 32. “‘Why don’t we just build our own?’” Continue reading...

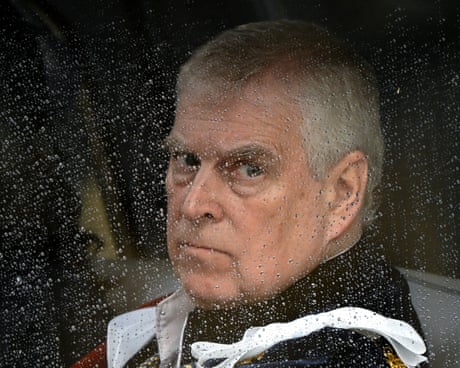

MPs considering investigation into Andrew’s role as UK trade envoy

Posted on Saturday February 21, 2026

MPs will meet on Tuesday to discuss the former prince, as it emerged he pestered ministers for a bigger government roleAn influential committee of MPs could launch an inquiry into Andrew Mountbatten-Windsor’s role as a UK trade envoy despite his arrest, it is understood, as it emerged that the disgraced former royal pestered ministers about getting a bigger government role.After his arrest on Thursday on suspicion of misconduct in public office, the cross-party business and trade committee said it would meet next Tuesday to discuss a possible investigation into the role he held from 2001 to 2011. Continue reading...

Market Watch

Opinion

Ukraine is the biggest and most consequential of all the American betrayals | Simon Tisdall

Posted on Saturday February 21, 2026

This Ramadan in Gaza we pray for mercy, share what we have and light a single candle for hope | Majdoleen Abu Assi

Posted on Saturday February 21, 2026

The 60-second rule? Colour theory? Yet more ways we’re supposed to live our lives | Francesca Newton

Posted on Saturday February 21, 2026

From handsome prince to a ghost behind glass, Andrew’s face tells the story of his decline | Fay Bound-Alberti

Posted on Friday February 20, 2026

How to win friends and influencers: Labour’s new social media strategy is a step into the future | Kirsty Major

Posted on Friday February 20, 2026

These atrocities in Sudan were entirely predictable. So why did the rest of the world fail to stop them? | Husam Mahjoub

Posted on Friday February 20, 2026

Sign up to Matters of Opinion: a weekly newsletter from our columnists and writers

Posted on Thursday June 26, 2025

I see two things in Gorton and Denton: palpable frustration and the need for wise voting to stop Reform | Polly Toynbee

Posted on Friday February 20, 2026

Do you remember your first crappy job? Today’s young people would wish for half your luck | Gaby Hinsliff

Posted on Friday February 20, 2026

Can Europe survive without US defence? Surprisingly, the Baltic sea nations are showing the way | Elisabeth Braw

Posted on Friday February 20, 2026

Madeline Horwath on the end of the Winter Olympics – cartoon

Posted on Saturday February 21, 2026

The Guardian view on Trump’s Board of Peace: serving private interests more than public good | Editorial

Posted on Friday February 20, 2026